By Dr. Said El Mansour Cherkaoui – Oct 2, 2015

In June 2014, the BRICS group formed by the so-called emerging economies of Brazil, Russia, India, China and the new member, South Africa had effectively signed a memorandum of understanding aimed at creating a new international financial institution. A year later, these same countries materialized this project by capitalizing the New Development Bank with 200 billion dollars as liquid assets. This banking organization was designated by the BRICS Development Bank whose active capital was endowed with 100 billion dollars below a monetary reserve of a currency worth more than 100 billion dollars.

Currently, this New Development Bank, also known as BRICS Bank, has been approved by the Standing Committee of the National People’s Congress during its meetings which were held till July 1, 2015. The authorities in India and Russia had already approved the creation of this bank. While South Africa will present the related ratification documents during this month of July 2015 during a meeting of BRICS countries taking place in the Russian city of Ufa

From this perspective, the other bank promoted by China as an alternative to existing development institutions, such as the IMF and the World Bank, is the new Asian Development Bank, known as the Asia Infrastructure Investment Bank. , which was created in October 2014. As a snub to the Washington administration, Britain and Germany are among its 57 member states.

The following Article is written to celebrate the Memoirs of Yves Barel (IREP-Grenoble) and Celso Furtado (Sorbonne-Paris and Brazil), the Two Vectors – Thinkers who traced the economic contours of my trajectory in the orbit of Research and my long crossing of the intellectual desert of economic development to reach the oasis of the Doctorate in France.

Dr. Yves Barel

Dr. Said El Mansour Cherkaoui

Dr. Celso Furtado

Dr. James Garrett and Dr. Said El Mansour Cherkaoui invited by the Government of China, an initiative expressing China’s ambition and objective to play a key role in international trade and finance.

Global Economic Emergence and its Foundations for Structural Emancipation

The evolution of the world economy had been justified by developmentalist theory in order to accelerate the integration of Third World countries into the international market, following their decolonization. Subsequently, developmentalist theory was also used and considered as a platform for insertion into the economic and political machinery favoring globalization. This approach was criticized for its stated desire to omit the specificities and diversities characterizing societies in the South.

Faced with this kind of ignorance, the notion of dependence was developed in Latin America or by Latin Americans who wanted to effectively thwart the globalization of production, the international division of labor and the multinationalization of the exploitation of raw materials which were all evaluated as a regional manifestation inherited from imperialism.

“The first works insist on economic dependence (deterioration of the terms of trade and more generally exploitation of peripheral states forced to integrate into the system of international capitalism). It is interesting to note here that, contrary to the developmentalist perspective, dependency theory does not consider “underdevelopment” and “development” as two successive stages but as two functions of the same system.

Within the framework of the confrontation of these theories and the corresponding strategies of economic development, the creation of this New Development Bank has therefore remained a demand of structuralist economists since the mid-1950s. It is in a way one of the financial derivatives of the followers of Keynesianism doctrine of development.

This economic orientation favoring recovery and growth first took root in countries that had broken the prohibitive and mercantile Iberian colonial yoke and subsequently aspired to emancipation from successive British and North American tutelage. In this, she had marked out the meanders of structuralist thinkers in Latin America under the aegis first of Raul Prebrish and later of CElso Furtado.

Celso Furtado also became the direct manager in the administration of Brazilian President Juscelino Kubitschek. Through this function, he had effectively begun the application of economic methods and recipes seeking to neutralize the consequences and generalizations of the aforementioned developmentalist policies. Among the initiatives taken was indeed the creation of the “National Bank for Economic Development” which was advocated by Celso Furtado with the backing of the World Bank and the International Monetary Fund.

In such a framework, the roots of the New Development Bank of the BRICS Bloc can be traced back to the old attempts of Latin American countries to want to provide their economies with a central bank capable of financing their development projects without increasing the interest rates, inflation rates and external borrowing requirements which reverberated with destructive conditions on economic development and its political ambitions for national independence.

In this framework, the long dominance of the US dollar since the signing of the Bretton Woods agreement and the creation of the Nixon administration of Petrodollars (oil shock of 1973) were beginning to show cracks and weakness in resolution, remittance and refinancing of international financial transactions.

Since then, events such as the Cold War, regional conflicts and global economic crises have shaken the predominance of financial tools and the organizational instruments put in place by the United States concerning the circulation of foreign currencies and the regulation of investments in recipient countries in Europe and Asia. Faced with this structural financial dependence, South-South cooperation initiatives were taken since the beginning of the new millennium and were subsequently consolidated by regional agreements which effectively sought to counterbalance the promotion of free trade agreements. advocated by the United States and the European Union.

These agreements tended to form tariff blocks geared towards the needs of the countries of the North. Similarly, given the tradition that infrastructure projects subject to agreements with neighboring countries or partners in South-South cooperation often come up against the risk of cancellation or reduction of relative investments given the cuts and adjustments made in national budget allocations. Indeed, the projects carried out by triangular companies within the framework of South-South cooperation are frequently financed by official development assistance and therefore remain exposed to the vagaries and budgetary restrictions adopted in the national budget.

With this in mind, the Latin American countries of the Bolivarian Alternative for the Americas (ALBA) group decided in April 2008 to create a common monetary policy body, a currency of account for their commercial relations, a clearing house for payments and a reserve fund for commercial transactions. In May 2009, seven South American countries (Argentina, Bolivia, Brazil, Ecuador, Paraguay, Uruguay and Venezuela) founded the Bank of the South which was endowed with a capital of 7 billion USD for the purpose of financing development projects. There is also talk of extending this approach in the direction of a monetary union or a monetary stabilization fund.

In Southeast Asia, member states of the Association of Southeast Asian Nations (ASEAN) had signed the extension of the Multilateral Credit Agreement (Chiangmai Initiative). In February 2009, their finance ministers – joined by those of China, Japan and South Korea – increased the volume of this agreement to 120 billion USD.

http://www.senat.fr/rap/r13-087-1/r13-087-1_mono.html

New Development Bank by Emerging Countries: BRICS

The system based in Western banking institutions and the recent financial scandals stemming from Libor (London interbank offered rate) and other related fraudulent behaviors had increased the reluctance of emerging countries to continue to be financed by a system that remained focused solely on lending volume as a key measure of the success of funded projects. At the same time, the development and integration of resolution methods and the transfer of financial assets conveyed by the new information technology have added several determinations to the economies of emerging countries to establish their own channels to finance their infrastructures by directly using their own funds, without the inherent costs of intermediaries. Advances in technology have also made it easier to consult and plan infrastructure projects which will be financed as BRICS joint development projects for their own country and for the rest of the developing countries.

In addition, the need for alternative global financial instruments is increasing as bilateral trade has grown between emerging countries and between them and the rest of the developing world, the so-called underdeveloped countries , not so long ago. For these reasons, the financial institutions and establishments offered by Western companies, such as the regional agencies of the IMF, the World Bank and the Overseas Private Investment Corporation, are considered organizations dominated by shareholders and Western states. This control is seen as a new challenge for the success of projects oriented towards the development of national resources and related infrastructure.

From this perspective, the other bank promoted by China as an alternative to existing development institutions, such as the IMF and the World Bank, is the new Asian Development Bank, known as the Asia Infrastructure Investment Bank, which was created in October 2014, as a snub to the Washington administration, Britain and Germany are among its 57 member states.

Creation of Commercial Blocks, A Complement to Financial Autonomy:

To avoid such obstacles and to reduce costs and time in terms of achievements, emerging economies are developing regional free trade blocs and financial aspect treaties. For these reasons, BRICS members seek to strengthen bilateral trade relations without relying on the assessment or approval of bodies controlled by Western powers. The other decisive aspect in this declared desire for world-class financial independence and regional commercial location is the total costs invoiced by the credit institution which it considers to be closely associated with and under the direct influence of the dollar for transactions and for the development of international trade in commodities and primary products.

The implications of all these new forms of competitiveness at the level of financial transactions and their considerable impact on the balance of payments, in particular the current accounts of the countries concerned, have become unequivocal for emerging countries. For this, their parades remained focused on the creation, circulation and control of new currencies despite the fact that these same financial settlement instruments and payment methods will first only be accepted within certain trading blocs. before achieving international acceptance. The establishment of regional regulatory banking institutions for the routing of these financial flows aim to be fiduciary and financial actors at the global level are the first signs of such an approach.

In this international regionalization of financial agreements, the members of the BRICS bloc are indeed seeking to plant the first seeds of a wider harvest of their financial cultures and this beyond their own territorial or even regional borders. Indeed, these financial emancipation efforts remain undeclared but which in reality tend towards the creation of financial alternatives that want to be non-competitive but in fact they stand out in a political trajectory towards the establishment of the first structures of financing whose objectives remain framed in the areas of national development without interference from the liberal ideologies promoted by Western banks in their sanction and their granting of loans and borrowings for the development of projects in third countries.

Gradual Consolidation of Southern and Emerging Countries against the Union of Western Banks

In this perspective, the initiative of the creation of this New Development Bank is in fact only a preamble to a longer march towards the emergence of new forms of negotiation and acquisition of funds for the financing of relations South-South trade. Without financial guarantee, the effects and performance of developing countries at the level of international trade remain subject to international banks which, through their financial weight and their manipulation of the conditions for acquiring loans, can influence the course and volume of trade. between developing countries. This step of creating local financing conditions therefore remains essential as a response to the omnipresent domination of Northern countries in setting pricing conditions, designating rates for international loans and the destination as well as the main beneficiaries of these same international commercial relations.

This is more vivid and clear when one takes into account the dependence of developing countries and potentially emerging economies on the financing of their infrastructure projects and on the consolidation of their own political and strategic choices concerns the economic direction, the sectoral allocation and the budget of their own finances.

In order to protect themselves against Western currency instability and fluctuations, BRICS BANK member countries are requested to also provide means and financial resources to counter the influence of lending institutions provided by the West and across the world. appreciation or devaluation of the US dollar, particularly in the wake of the current financial crisis traversing Western economies and the regional conflicts generated by the consequent race for natural resources around the world.

In June 2014, the BRICS group formed by the so-called emerging economies of Brazil, Russia, India, China and the new member, South Africa had effectively signed a memorandum of understanding aimed at creating a new international financial institution. A year later, these same countries materialized this project by capitalizing the New Development Bank with 200 billion dollars as liquid assets. This banking organization was designated by the BRICS Development Bank whose active capital was endowed with 100 billion dollars below a monetary reserve of a currency worth more than 100 billion dollars.

Currently, this New Development Bank, also known as BRICS Bank, has been approved by the Standing Committee of the National People’s Congress during its meetings which were held till July 1, 2015. The authorities in India and Russia had already approved the creation of this bank. While South Africa will present the related ratification documents during this month of July 2015 during a meeting of BRICS countries taking place in the Russian city of Ufa

BRICS A Recovery Cooperative for Growth and Economic Development

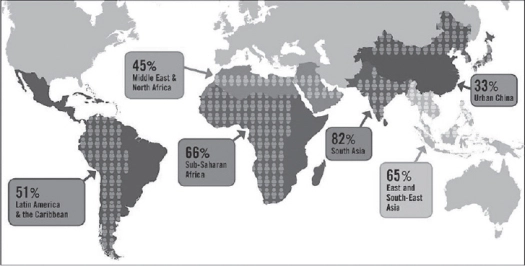

The BRICS Bloc when its members are considered in terms of demographic and economic standards, their respective economies can be classified as heavyweights in the global environment. Indeed, the economies of the BRICS bloc are increasingly emerging as new competitors to the foundations and offshoots of the New World Order inherited from the presidency of Bush Sr. Indeed, taking gross domestic product into account, the BRICS group is currently home to 42 percent of the world’s population and accounts for about 20 percent of the global economy. Using purchasing power parity as a basis, the BRICS Five countries also hold 30 percent of the world’s GDP.

Similarly, the total trade between the BRICS countries is $6.14 trillion, almost 17 percent of the global total. In terms of investments worldwide, their contribution stands at 11 percent of the investments made. China, India and Brazil are also ranked among the largest economies in the world with over $2 trillion (€1.25 trillion) in nominal GDP.

By way of comparison, in 2015, the members of the Global Club of privileged “Elite” countries were the United States, China, Japan, Germany, France, the United Kingdom and India. Their ranking with respect to respective GDP in trillion US dollars is as follows: US $18.1 – China $11.2 – Japan $4.2 – Germany $3.4 – UK $2, 9 – France $2.5 – India $2.3 – Brazil $1.9 – Italy $1.8 – Canada $1.6.

Organizational Structure of the New Development Bank

Within this New Bank, each member of the BRICS bloc will have a reserved seat on the Representative Council for their Minister of Finance or the President of their Central Bank. The other innovation is that membership of this bank is not limited only to members of the BRICS bloc, as is the case for other Western and international financial institutions. BRICS Bank will be headquartered in Shanghai, with India holding the presidency for its first year of operation; while Russia was granted the chairmanship of the board of directors. It was also agreed that an African regional center of the Development Bank will be established in South Africa.

During a recent interview conducted by RT (Russian international television), the new president of the Development Bank, Kundapur Vaman Kamath also declared that a “significant part” of the bank’s activity could be carried out in foreign currencies. local. “I haven’t applied my mind what the consequent effect will have on other currencies. But this concerns more our local currencies and it is our own countries that are concerned since this measure will significantly reduce exchange rate risks. He also predicted that by April 2016, the New Development Bank could issue its first loan for a national-level infrastructure project.

In reality, the preference given to the use of the local currency of the member countries is a financial practice advocated to reduce the resistance of national banks and also to facilitate local and regional transactions with the aim of integrating them into the activity of credit and loan from the New Development Bank and this without recourse to the international financial market or the use of foreign currencies. Such an adaptation also seeks to avoid the jolts and volatility of the financial market based on the US Dollar and the Euro.

Mr. Kamath also clarified: “I think clearly the establishment of this bank is also a signal that developing countries are now able to stand on their feet and in their own way to implement set up their own institutions. Going forward, we are really looking to broaden the membership base for new members.” In this perspective, the New Development Bank remains open to other emerging countries, such as Mexico, Indonesia, or Argentina, once this country settles its debt burden.

Pending such prospecting, the initial funding comes from each current BRICS member who will contribute an equal share in the creation of a start-up capital of 50 billion dollars while the full participation remains in the order of 100 billion dollars. This capitalization represents a loan fund in times of crisis and is called the Contingent Reserve Arrangement (CRA). China has already contributed $41 billion, while Russia, Brazil and India will add $18 billion, while South Africa, the newest member, will contribute $5 billion. Since China’s contribution represents 39.5 percent of the total, this country therefore holds the largest share of voting rights in the Central Administration Committee.

Bibliographic Notes and Additional Notes for Clarification

On the 07/09/2015, Russian President Vladimir Putin is meeting with BRICS leaders in an expanded format at the BRICS / SCO summits in the Russian city of Ufa. See the video on the following link: http://rt.com/on-air/putin-meets-brics-leaders/

The French Senate: Escape of capital and finance: knowing better to fight better (Report)

http://www.senat.fr/rap/r13-087-1/r13-087-1_mono.html

NB: * Comments can be sent directly to Dr. Said Cherkaoui: saidcherkaoui@triconsultingkyoto.com

http://creativecommons.org/licenses/by-nc/4.0/

:strip_icc():format(webp)/reaganomics-did-it-work-would-it-today-3305569-FINAL-5bc4c49a46e0fb0026b4a44a.png)

.

. % in September 2022, with inflation pressures broadening beyond food and energy in most countries.

% in September 2022, with inflation pressures broadening beyond food and energy in most countries.