TRI CONSULTING KYOTO – TRI CK USA supports you in your investment projects, whatever their form: new sites, extensions, industrial or technological partnerships, acquisitions or financial investments.

Morocco Favorite Destination for International Investment

BE SMART : CHOOSE MOROCCO !

Here is an overview of Morocco’s investment and economic environment that we hope will enhance your interest in developing trade, financial, and cultural relationships with the Moroccan people.

If you are looking to benefit from an environment conducive to establishing excellent business relations, you are considering Morocco as your destination for export or the source of your imports and you are going to create real jobs and have good returns on your investments, we can help you to find the right connection and facilitate for you the process through our assessment and evaluation of the present conditions of doing business in Morocco.

Contact us by sending an email to: saidcherkaoui@triconsultingkyoto.com

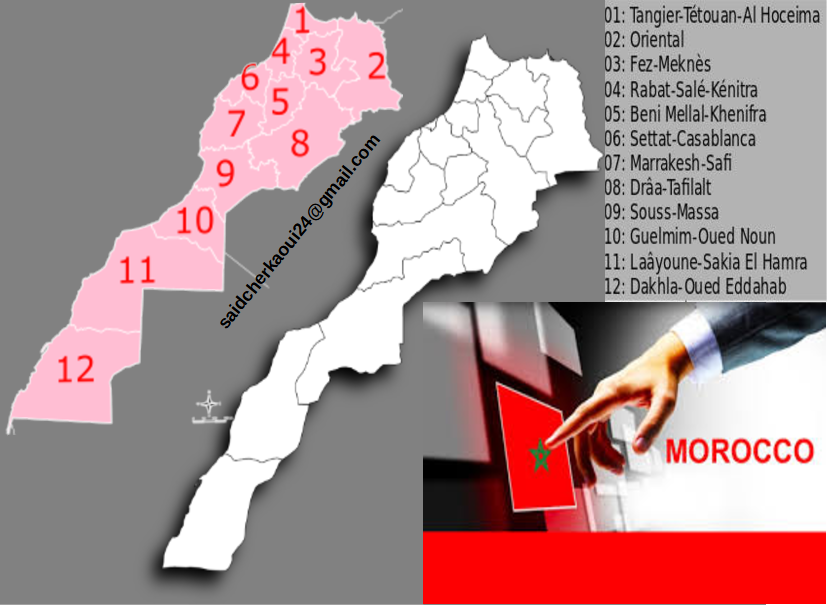

Each of Morocco’s 12 regions also leads its own investment promotion efforts through Regional Investment Centers (CRIs)

El Jadida et Doukkala are integrated in the Casablanca – Settat Region

Request for Additionnal Info, contact: saidcherkaoui@triconsultingkyoto.com

INVEST IN MOROCCO

This used to be the History of the Clash of Civilizations and now this is the space for new discoveries to be made, including investing in the present-day emergence of a new mutually beneficial relationship

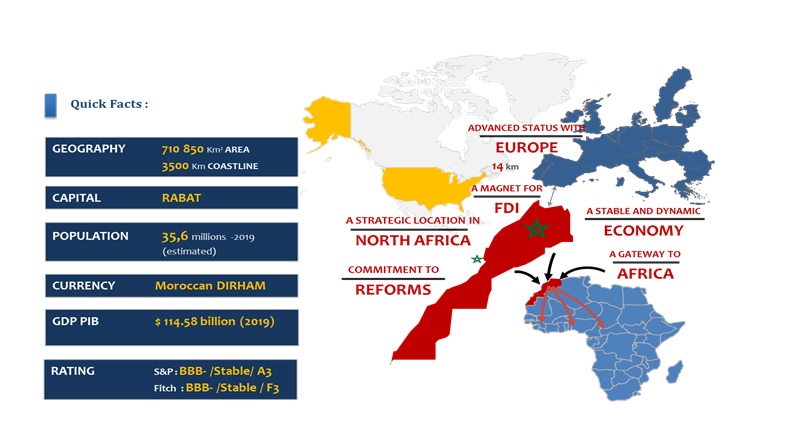

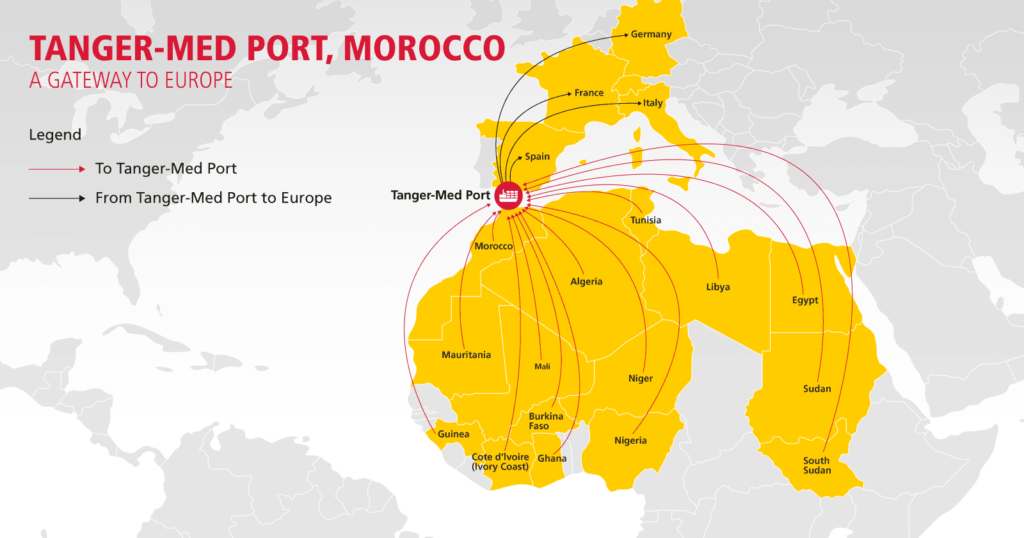

Morocco is a gateway and path to many regions and countries in Africa and the Middle East. Morocco is embedded and located within a geostrategic environment that is conducive to facilitating the implementation of services, and industrial, maritime, or agricultural operations. These initiatives can also be steering toward integration in the regional economies or for the development of distribution systems along with an expansion in the Western and Eastern Mediterranean regions, the European Union, the United Kingdom, and the neighboring North and Sub-Saharan African economies.

Morocco is fast becoming one of the best emerging markets for investment. Over the last decade, Morocco has witnessed an accelerated process of political, economic, and social reforms, and its steady economic growth and strategic geographic position make it an investment opportunity well worth considering.

Already in Morocco’s 2018 Doing Business ranking (69th out of 190 countries), published by the World Bank

7 Top Pillars of Business Wisdoms

- Cost Competitiveness

- Strong and Stable Macroeconomic Performances

- Free Trade Access to One Billion Consumers

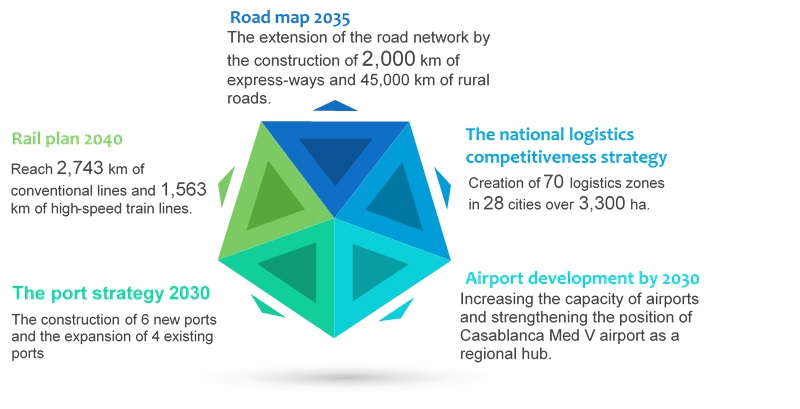

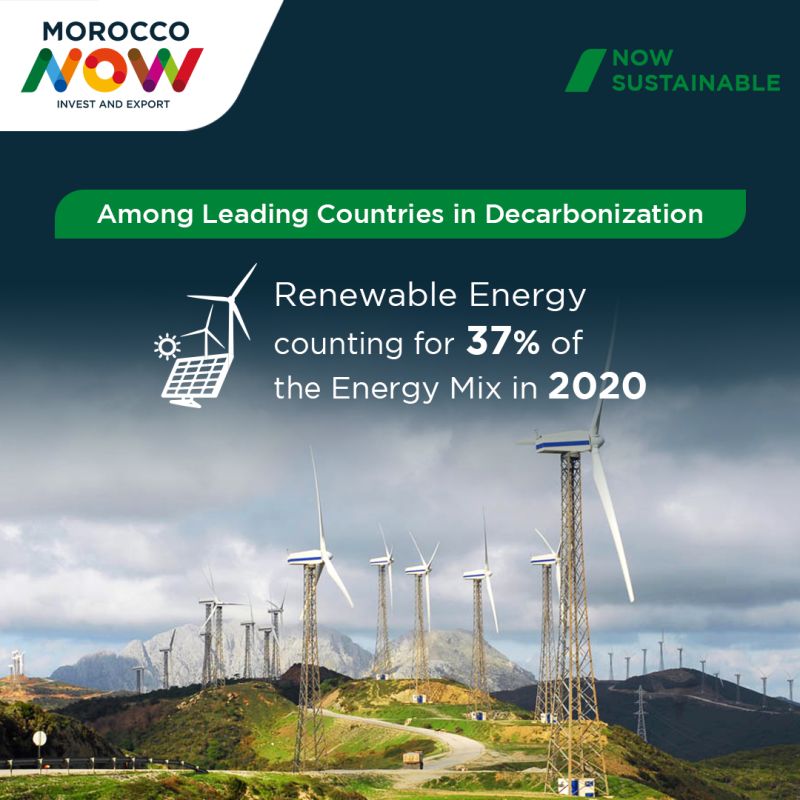

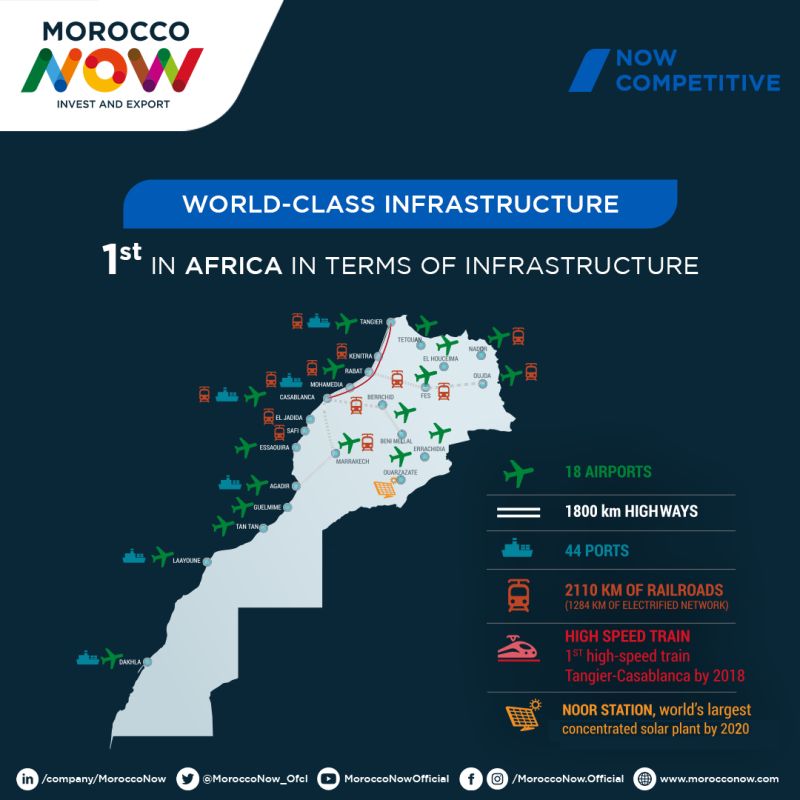

- World Class Infrastructure

- Qualified Labor Force

- Sectorial Plans

- Constantly improving Business Climate

Strong Points

– A legal framework and assistance measures very favorable to investors

– Relatively low salaries

– A strategic position, not far from Europe

– A young and relatively well-trained population

– Strong growth…

What are the Government measures to motivate investment in Morocco?

The new investment charter which was introduced in July 2016 as part of Law 60-16, and replacing a previous charter implemented in 1995, creates free-trade zones in each of the 12 regions of the country, recognizes indirect exporter status, and creates incentives for export-oriented and industrial companies.

It also restructures investment promotion activities under the centralized Moroccan Agency for Investment Development and Export, including Maroc Export https://marocexport.gov.ma/, the Moroccan Investment Development Agency falling under the purview of the Ministry of Industry, Trade, Investment and Digital Economy.

A General Directorate for Trade, a General Directorate for Industry and an agency dedicated to developing the digital economy and e-government were also created under the new charter of investments.

Hub for the Global Automotive Industry

Foreign Direct Investment inflows by country and sector

After a decline during the global recession, FDI (Foreign Direct Investment) flows to Morocco increased in 2014 and 2015, exceeding USD 3 billion. In 2016, however, flows fell by 29% to USD 2.32 billion. The country’s stability should attract more investors. In addition, a vast project of economic modernization has been launched to boost FDI. Casablanca in particular aims to become an international financial center. Traditionally, France, Saudi Arabia, and Spain have been the three main investors. FDI is mainly concentrated in the real estate sector, followed by industry and tourism.

Source: United Nations Conference on Trade and Development (UNCTAD)

Source: Foreign Exchange Office of the Ministry of Finance

Investment Opportunities in Morocco

Invest in Morocco

If you want to have a presentation of a given African country to be profiled by us here and as a publication of TRI Consulting Kyoto – TRI CK USA, please share that we us by sending an email to cherkaouijournal@gmail.com

For engagement on a business level, please contact us by sending an email to: saidcherkaoui@triconsultingkyoto.com

You can also fill out the forms that are at the foot of the present article on our website: https://triconsultingkyoto.com

Best wishes for success

RELATED NEWS

The Moroccan Investment and Export Development Agency (AMDIE) is the national agency responsible for developing and promoting investments and exports in Morocco. AMDIE’s services include:

- Informing potential investors about Morocco’s regulatory framework and investment opportunities

- Assisting investors in their quest for investment

- Promoting national and international investments

- Promoting the export of goods and services

- Supporting all economic sectors throughout their life cycle

- Prospecting new international clients

- Networking Moroccan exporters with foreign contractors and institutional players in target markets

- Internationalization of Moroccan investors

- Export financing and hedging solutions

- Data on promising foreign markets

Each of Morocco’s 12 regions also leads its own investment promotion efforts through Regional Investment Centers (CRIs).

AMDIE was founded in 2009.