★ ★ Foreign Investment and Foreign Trade ★ Morocco has ratified 72 investment treaties for the promotion and protection of investments and 62 economic agreements – including with the United States and most EU nations – that aim to eliminate the double taxation of income or gains. Morocco is the only country on the African continent with a Free Trade Agreement (FTA) with the United States, eliminating tariffs on more than 95 percent of qualifying consumer and industrial goods. ★ ★ Morocco’s Investment and Export Development Agency (AMDIE) ★ is the national agency responsible for the development and promotion of investments and exports. Following the reform to the law governing the country’s Regional Investment Centers (CRIs) in 2019, each of the 12 regions is empowered to lead their own investment promotion efforts. The CRI websites aggregate relevant information for interested investors and include investment maps, procedures for creating a business, production costs, applicable laws and regulations, and general business climate information, among other investment services. ★ ★ ★

AUTOMOBILITY TECH

Location:

The country in northwest of Africa is bordered by the Strait of Gibraltar and the Mediterranean Sea in north, by Mauritania in south, by Algeria in east and in west by the Atlantic Ocean.

Political Environment: In accordance with Article I of the 2011 Constitution, Morocco is a constitutional, democratic, parliamentary and social monarchy:

The king is the Head of State of Morocco, the Supreme Representative of the nation, the symbol of its unity and the guarantor of the permanence and of the continuity of the State. His Majesty presents also the Supreme Arbiter between the Institutions and appoints the Head of Government from the political party with a majority of seats to act in the Chamber of Representatives.

The parliament which is composed of two chambers (the Chamber of Representatives and the Chamber of Councillors) exercises the legislative power in the Kingdom, votes on laws, controls the activities of the Government and evaluates public policy.

Executive power is exercised by the government

Economic Overview:

The Moroccan economy is characterized by a great openness to the outside world. Since the early 80s, Morocco has adopted an economic and financial openness policy aiming at improving the liberalization of foreign trade, largest integration of the Moroccan economy into the international economy and at strengthening of contribution to the consolidation of a multilateral trading system.

In this regard, significant advances in the modernization of economic and financial structures and upgrading of the legal and institutional frameworks have been accomplished. The aim is to permanently accelerate economic growth in Morocco and to improve living conditions of its citizens.In this context, Morocco undertook the simplification of foreign trade procedures, a reduction in tariff protection, the elimination of non-tariff measures, the improvement of the business and investment environment, the expansion and the diversification of economic and trade relations and finally, regular contributions to consolidate the multilateral trading system. This opening is further illustrated by the signing of various free-trade agreements by the Kingdom with its main economic partners, including the European Union, the United States, and in both Arab and African countries. In addition, a set of legal texts were enacted or modified to support these reforms. These include, for example the Investment Charter, the Commercial Code, the law establishing the commercial courts, the Customs Code, the Law on free pricing and competition, the regulation of the State’s markets, and the Law on the protection of industrial and commercial property.

Moreover, the establishment of new sector policies based on comparative advantages of the Moroccan economy (Industrial acceleration Plan 2014-2020, Vision 2020 for Tourism, Vision 2015 for the Craft Industry, Rawaj Plan for Trade 2020, the Green Morocco Plan for Agriculture, Halieutis Plan for Fishing. etc) should promote, in the coming years, a sustained and sustainable growth.

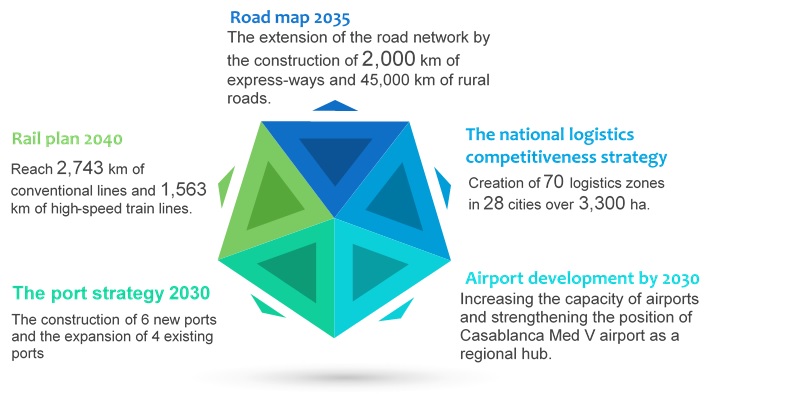

In order to support these sectoral strategies and strengthen long-term growth, Morocco has initiated several strategies relating to infrastructure and logistics:

Moreover, the EU has granted Morocco an “advanced status” which gives it the possibility to further integrate into the European Single Market and to participate to some inter-European cooperation programs reserved for members only, thanks to the privileged relations between Morocco and the EU, and given the progress realized in the political, economic and social fields, as well as the many reforms undertaken by the Kingdom.

Finally, the process of economic openness and integration into the global economy is consolidated through the conclusion of free-trade treaties with the United States, the European Union, EFTA, Turkey, member States of the Arab League as part of the Greater Arab Free Trade Area, and the Mediterranean Arab countries as part of Agadir Agreement.

Furthermore, the EU has granted Morocco an “advanced status” which gives it the possibility to further integrate into the European Single Market and to participate to some inter-European cooperation programs reserved for members only, thanks to the privileged relations between Morocco and the EU,and given the progress realized in the political, economic and social fields, as well as the many reforms undertaken by the Kingdom.

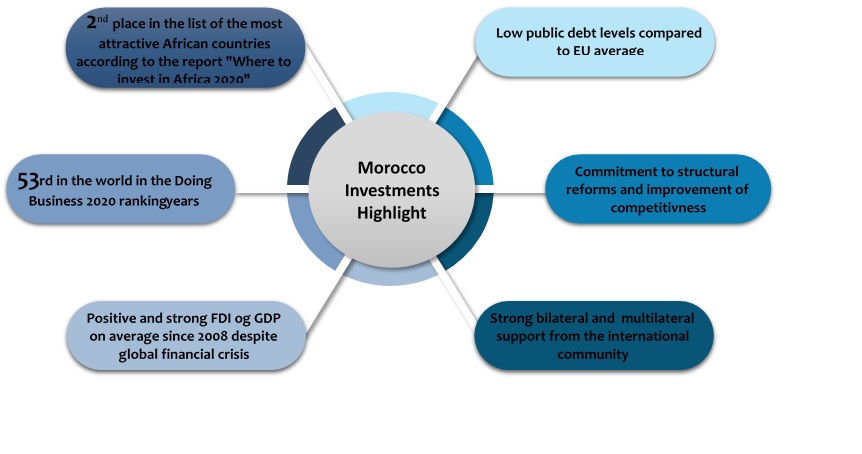

On the continental level, the reinforcing cooperation with African countries has gained new impetus during the reign of His Majesty King Mohammed VI. This new vision of openness has materialized through the conclusion, since the early 2000s, of more than 1000 cooperation agreements with more than 40 countries and by the upward trend in the country’s direct investments in sub-Saharan Africa, which have reached $ 3 billion in the past 10 years, placing our country as the 2nd African investor and the 1st investor in West Africa.

In this context, Morocco has the ambition to position itself as an essential export platform for investors wishing to target dynamic markets with high growth potential in Africa. As such, Casablanca Finance City (CFC) offers international investors a platform strongly connected with Africa and privileged access to investment opportunities through, among others, the Africa 50 Fund which aims to meet development needs infrastructure in Africa.

Publications par Said El Mansour Cherkaoui

★Version Française ★ ★ Publications par Said El Mansour Cherkaoui ★★ ★ ★ ★★ ★Morocco Profile: Investment and Trade Trends

★★ ★ ★ ★ ★ Morocco Profile: Investment and Trade Trends ★ Foreign … Continue reading

Said El Mansour Cherkaoui Articles on USA – Morocco Relations

Le Nouveau Défi du Maroc: La Conciliation de la Croissance Economique, la Régionalisation et la Globalisation

Déjà j’écrivais et j’exprimais toute cette analyse et cela a la date du 14 Novembre, 2014 et personne n’écoutes la voix de la vérité comme par hasard. Aujourd’hui, le 19 Avril 2022, plus que huit ans après on est pire qu’a cette date du 14 Novembre 2014 Lire la suite « Le Nouveau Défi du Maroc: La Conciliation de la Croissance Economique, la Régionalisation et la Globalisation. » Publié par Said El Mansour Cherkaoui

Marrakech Investor Day : le pôle régional de l’investissement au service de l’économie

Marrakech Investor Day : le pôle régional de l’investissement au service de l’économie – 7 avril 2022 Marrakech – La première édition du « Marrakech Investor Day » (Journée des Investisseurs) a été organisée hier, mercredi, au Musée Mohammed VI de la Civilisation de l’Eau au Maroc (AMAN), à l’initiative du Centre Régional d’Investissement Lire la suite

Presentation of the Subsidies, Financing Plans and Tax Benefits for Investments Realized in Morocco

With regards to the financing of investments, Morocco has subsidy funds, the Kingdom also provides financing plans and grants tax advantages. A non-exhaustive list is presented below:

- Industrial Development and Investment Fund (FDII): Companies can benefit from a subsidy for tangible and intangible investment that can be up to 30% of the investment’s amount excluding taxes;

- Morocco PME:

- ISTITMAR CROISSANCE program for VSEs: Support for extension and diversification projects that can reach 30% of the investment’s amount capped at 2 Mn MAD, for very small businesses having achieved or forecasted a turnover less than or equal to 10 Mn MAD.

- IMTIAZ CROISSANCE program for SMEs: support for extension and diversification projects that can be up to 20% of the investment program, capped at 10 Mn MAD, for small business which carried out or forecasted turnover does not exceed 200Mn MAD.

- Investment Promotion Fund (FPI): This fund manages the operations relating to the assumption of certain advantages by the Government granted to companies which investments respect the conditions set forth in the investment charter:

- Support for the acquisition of a land in specific areas up to 20% of the purchase cost.

- Participation in external infrastructure expenses up to a limit of 5% of the investment program’s total amount.

- Contribution to training costs up to a limit of 20% of the incurred expenses.

- Finishing, Printing, Dyeing Fund (FIT): This fund grants a 20% premium on equipment investment dedicated to upstream textile projects.

- “IDMAJ” program: This program aims to promote recruiting young graduates by granting companies offering a first professional experience the exemption from social contributions and payroll taxes.

- “TAEHIL” program: This program offers trainings to future hired employees and job seekers in order adjust their profiles to the specificities of the position to be filled and to the market’s requirements.

- “INMAA” program: This program aims to improve the industrial performance and the competitiveness of Moroccan industries by providing their teams training and support in Lean management for the implementation of Lean tools. The cost of this service can be subsidized up to 60% through the MOUSSANADA program.

- Value Added Tax (VAT) exemption5: Companies established in Morocco can benefit from the exemption or reimbursement of the VAT provided for by the Moroccan Tax Code, in the event of:

- Local acquisition of import of investment goods within the limit of 36 months starting from the beginning of the company’s activity.

- Import of the capital goods, materials and tools necessary for the completion of investment projects undertaken within the framework of an agreement concluded with the State under certain conditions.

- Existence of a VAT credit arising from the acquisition of certain investment goods that could not be absorbed by the collected tax.

- Corporate Income Tax (CIT) exemption: Industrial companies operating in activities included in the list provided for by the Government benefit from the advantages below:

- Total exemption from CIT for the first five consecutive fiscal years starting from the date the company starts operating.

- Application of a reduced tax rate of 28% to the local turnover carried out by industrial companies specialized in manufacturing or transforming tangible personal property and which tax result is less than MAD 100M (Approx EUR 9M) check current rate of exchange and new tax.

- Professional tax: Companies established in Morocco exercising a professional, industrial or commercial activity benefit from the exemption from professional tax during the first 5 years of operation7. The aforementioned exemption also applies, for the same duration, to lands, buildings of any kind, additions to buildings, new equipment and tools acquired during operation, directly or by way of leasing.

- N.B: To update according to current publications by the Governement of the Kingdom of Morocco

Ryad Mezzour – Ministry of Industry and Trade – Morocco

Invest in Morocco – Renault

Investing in Morocco – Opportunities for growth and a dynamic environment to do business

Bridge to Europe, Bridge to Europe, Gateway to Africa, Gateway to Africa and the Door to the Mediterranean Portal for the Mediterranean and Window to the Atlantic. To find out more Morocco

Initially, there was the Emergence Plan, initiated following a study by the McKinsey firm commissioned during Salaheddine Mezouar’s mandate in the Industry Portfolio (2004-2007).

Ahmed Réda Chami, tried to give substance to a National Pact of Industrial Emergence, a strategy focused on sectors in which Morocco is competitive through its cheap labor. Then came the Industrial Acceleration Plan (IAP), launched with great fanfare in 2014 by Moulay Hafid Elalamy, a few months after his arrival at the head of the Ministry of Industry.

Does Morocco have an economic development strategy?

Lire la suite « Articles Correspondants » publiés par Said El Mansour Cherkaoui

The Automobile Industry in Morocco

Renault and Tangier Med – Cluster for Automotive Platform for deployment of the input range

The Renault plant in Tangier is dedicated to the production of Lodgy and Dokker models, from stamping to assembly to sheet metal and paint. The project is located on 300 hectares with all utilities with a capacity of low cost vehicles. The Logdy family vehicle, the latest from Dacia, the “low-cost” branch of the Renault group, will be manufactured in this new factory.

Intended primarily for emerging markets, it will also be marketed in Europe. This unit, taking advantage of the low cost of labor, could create 6,000 direct and 30,000 indirect jobs in northern Morocco. Leading suppliers or subcontractors are already established in the export processing zone, located opposite Spain. This unit benefits from a tax exemption for companies for five years, VAT relief, training subsidies, financial aid for construction.

According to various sources, the cost structure of this project is € 1.1 billion committed in two tranches, of which equity capital, equity and current accounts amount to € 240 million, divided by 51% and 51% respectively. 49% between Renault-Nissan (France) and Caisse de Dépôt et de Gestion (CDG – Morocco). Renault’s financial contribution is therefore 122.4 million euros, while 117.6 million euros come from CDG, contributing 11.12% of the total amount of 1.1 billion euros. euros, while for Renault, the essential remains its contribution in technology and know-how. The Hassan II fund is one of the largest contributors to this project with an investment of 200 million euros in the form of a loan at a subsidized interest rate to Renault. Three other Moroccan banks Attijariwafa Bank, the Banque Populaire Group and the BMCE, provided funding of 105 million euros, with equal participation in the project aspect in infrastructure equipment and civil engineering.

These banks also finance the other subcontractor facilities which are formed by about 80 companies in order to supply spare parts for the production of cars by Renault as well as for the export to other Renault sites in Europe and Europe. elsewhere. In the structuring of this financing, the Moroccan State commits itself through a direct contribution of 95 million euros, (more than a billion dirhams), on the total amount of the first tranche of the investment. This amount was realized at the level of subsidies from the Moroccan State in the form of land developed off site of several hectares.

Among these financial interventions of the Moroccan State directly concern the infrastructural and logistic development such as the construction of railways and roads by the ONCF and the ONEP conceived for the needs of the transport of the cars intended for the export through in particular the new port of Tangier Med. This synergy is actually the responsibility of the Moroccan State which directly finances the equipment of the new facilities of storage and parking as well as the construction of port moles such as Tanger Med where all the port infrastructures are put at the disposal of the project as well as a storage space of several hectares reserved on the port to park cars waiting for export.

The second tranche is approximately 460 million euros (more than 5 billion dirhams) and was reserved through partial financing in the form of cash receipts – free cash flow and up to 40% to 60% by debt .

The interests of Renault in Morocco are mainly constituted by the desire to consolidate the control of the Moroccan automobile market and by the unique opportunities that are offered by the operation of Tangier. Renault is currently the dominant company in the Moroccan automotive market. The Dacia and Renault brands, owned and operated by Renault, represent respectively 20% and 17% of the market. Renault is already operating a plant in Casablanca and the increased production of this new plant will allow the company to maintain its market share as the Moroccan automotive industry grows.

Container bridge for exports to emerging and European markets

However, this facility meets a much more important goal for Renault than simply maintaining control of the Moroccan market. The Tangier industrial zone offers a number of significant advantages for industrial operations.

First and foremost, the Renault plant is located near the port of Tangier Med, allowing for easy and efficient shipment of goods. This port is located in a key geostrategic location at the intersection of Africa and Europe.

Renault plans to exploit the location of this port, as it will be shipped to Europe, Turkey, Africa and South America from Tangier. In addition, the port has developed a number of logistics and post-processing services dedicated to the automotive industry, which add greater value to Renault’s operations in Tangier.

In 2010, Renault employed 1,800 people in Morocco and assembly facilities accounted for 1.4 per cent of the Group’s total, whose production in 2007 was 28,764 vehicles, or 1 per cent of the Renault Group’s total.

Renault production started in Morocco in 2012 produced 229,000 cars in 2015. The initial annual production capacity of 170,000 models has increased significantly to 229,000 cars in 2015 and currently reach 400,000 vehicles per year.

“Today, we are reaching the full potential of this plant, which has a production capacity of 400,000 vehicles a year and has become one of the most efficient in the world,” said Carlos Ghosn.

Tangier, Morocco: 2015

Tangier as an industrial location for Renault has also helped structure the network of suppliers supplying the Renault plant and also for export to Europe and elsewhere. The Renault plant served as a magnet for these peripheral automotive parts suppliers, not only in northern Morocco, but also near and just north of Casablanca, in Kenitra, where PSA Peugeot Citroën is currently building a plant to be completed. 2019. Peugeot is planning an initial production capacity of 90,000 cars per year and 200,000 in 2022. Peugeot vehicles will mainly be destined for African markets.